Thursday, April 11th, 2024

Trying to define yourself is like trying to bite your own teeth.

— Alan Watts

MGT011A Lecture: accounting cycle - analyze, record steps

- accounting cycle

- analyze: Is this transaction relevant?

- record

- adjust

- report

- close

- accounting cycle: the analyze step

- accounting transaction: an economic event that must be recorded in accounting records

- could be anything that is a part of the accounting equation (e.g., assets, revenue, expenses, etc)

- some business activities aren’t relevant and thus aren’t included in the accounting records

- double-entry accounting: an accounting transaction affects at least 2 elements (could affect the same term — like assets) from the basic accounting equation (assets = liabilities + equity); also ensure that the two sides are in balance after the transaction

- ending retained earnings = beginning retained earnings + net income - dividends

- net income = revenue - expenses

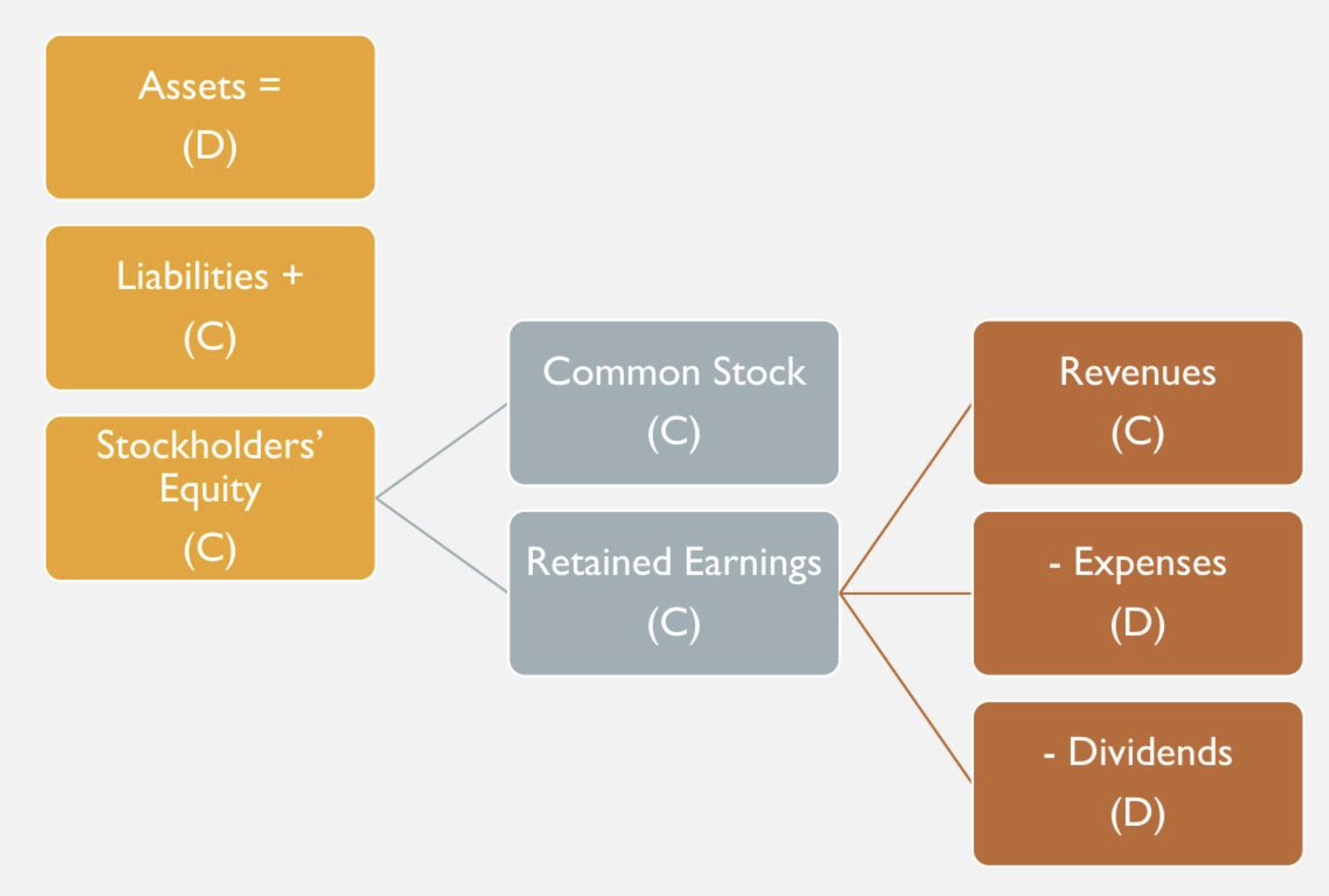

- expanded accounting equation

- assets = liabilities + equity

- assets = liabilities + common stock + retained earnings

- assets = liabilities + comon stock + beginning retained earnings + net income - dividends

- example transactions

- person investing $30,000 in a new company’s stocks

- both assets and equity increases by $30,000; equation is balanced

- prepaying rent for company’s location

- only assets changed: cash decreased, but prepaid rent (also considered rent) increased

- taking out a loan (with interest)

- assets (cash) increases and liabilities (notes payable) increases; balanced

- the interest is considered a financing expense that is only recorded when paid

- paying salary

- assets (cash decrease) and expenses increase; since expenses are negative in accounting equation, so equation is balanced

- person investing $30,000 in a new company’s stocks

- accounting transaction: an economic event that must be recorded in accounting records

- accounting cycle: the record cycle

- once an accounting transaction has been identified, record this transaction

- concepts

- account: an individual record that increases or decreases the company’s asset/revenue/expense/liability/equity/etc

- types of accounts: cash, equipment, wage expense, etc

- chart of accounts: a list of all types of accounts within the company

- accounting doesn’t use positive/negative signs; use “debit” or “credit”

- Debit doesn’t necessarily mean it’s a good thing (e.g., a debit to expenses isn’t great), vice versa.

- normal balance: how an increase is recorded for a given type of account

- Debit an asset account to increase its normal balance. Credit an asset account to decrease its normal balance.

- Credit a liabilities or equity account to increase its normal balance. Vice versa for debiting.

- DEALER: acronym for normal balance for each account type

- debits: Dividends (equity), Expenses (equity), Assets

- credits: Liability, Equity, Revenue (equity)

- general journal: records of accounting transactions

- source document: each transaction needs to have proof that it actually happened (e.g., receipts, invoices)

- account: an individual record that increases or decreases the company’s asset/revenue/expense/liability/equity/etc

- steps

- describe the nature, format, and purpose of the account

- journalize (record in general journal)

- date

- for each transaction, the debits are listed first, followed by credits (credit entries are indented compared to debits)